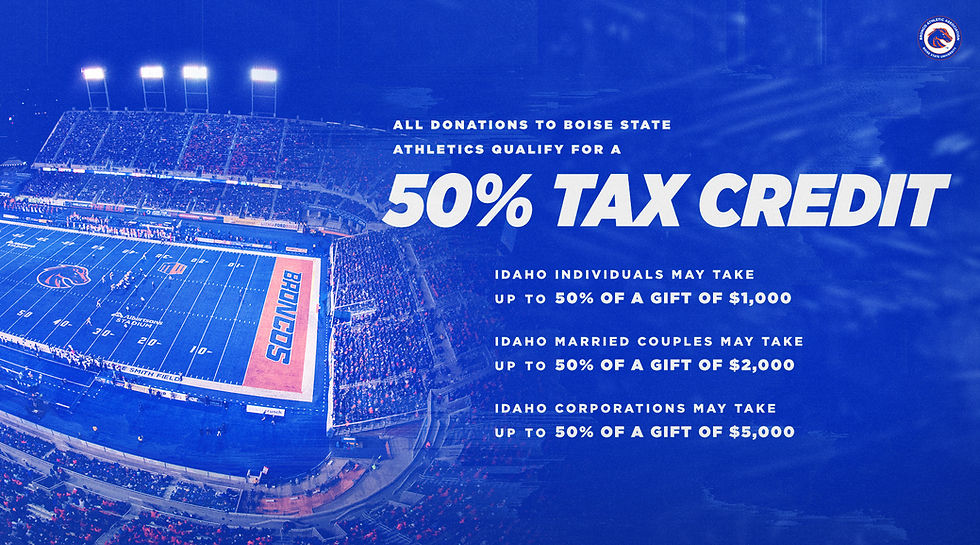

As an Idaho tax payer, your donations to the Bronco Athletic Association may be eligible for a 50 percent education state tax credit. This credit is available regardless of whether or not you itemize deductions. For those who do itemize, a charitable donation to the BAA allows income tax deductions on both your state and federal returns. A tax credit is a reduction to the actual tax you owe or an increase in your refund.

-

Idaho individuals may take up to 50% of charitable contributions up to $1,000 (a maximum tax credit of $500)

-

Idaho married couples may take up to 50% of charitable contributions up to $2,000 (a maximum tax credit of $1,000)

-

Idaho corporations may take up to 50% of charitable contributions up to $10,000 (a maximum tax credit of $5,000)

We encourage you to contact your tax advisor for further consultation.

Additional Resources: Idaho Statute Title 63 Revenue and Taxation Chapter 30 Income Tax